Merchants: How to Win a Credit Card Chargeback Dispute

In my previous article, How to Stop Fraudulent Chargebacks, I explained methods you can you to help prevent the chargeback from happening, BUT if the chargeback has already happened, then preventing a future one is only protective measures to help you not face this issue again, however, it doesn't solve your current problem. So in today's article we are going to discuss How to Fight Back, and win your dispute.

THE FRAUDULENT CHARGEBACK ARRIVES...*Sigh*

Yeah, it may feel like one of the worst moments of your life, especially if the chargeback is for thousands of dollars. Heck, even a $50 chargeback ruins my day. BUT the good news is, you DON'T have to "just deal with it", you can, and must fight back no matter how angry or depressed you are because you can stand a strong chance of winning the dispute. So compose yourself and get ready for battle.

STEP 1: GATHERING EVIDENCE

First you need to try your best to "take emotion out of it" and focus on making your case solid. You need to act quickly because most credit card chargeback disputes give you limited time to submit your side of the story.

Your chargeback will state the transaction date and amount as well as a code for the reason of the chargeback. Before you even get into looking up the code, first pull up the customers order, shipping information, tracking information and see if there is any correspondence from the customer that you somehow may have missed. It helps to print out all of this information.

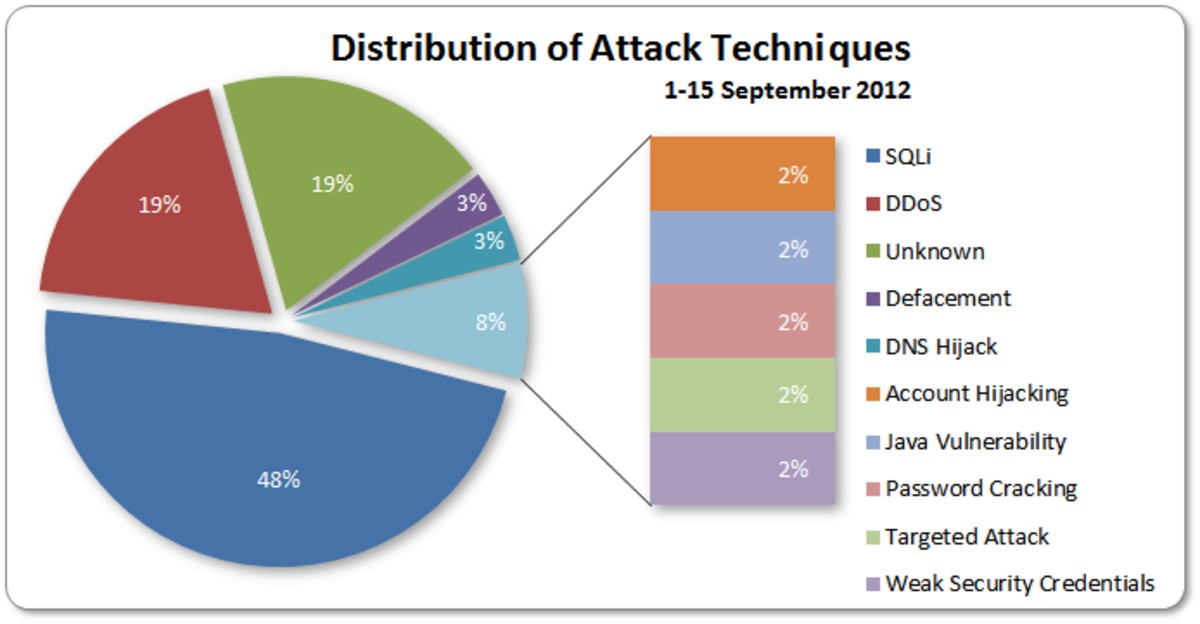

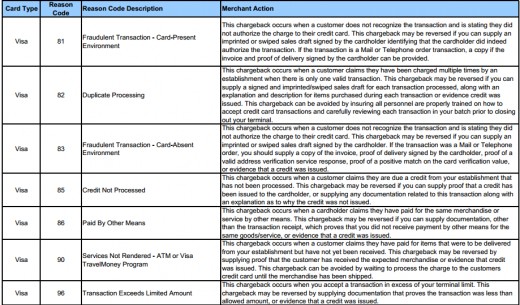

Now it is time to look up the reason for the chargeback. As you will see from the provided link, MerchantConnect.com has provided a complete list, broken down by credit card issuing company that shows the code and what it means. For example, if you look at this list (here is an excerpt from multiple pages):

Visa "Code 90" means "Services Not Rendered - ATM or Visa TravelMoney Program; and the meaning of a Code 90, in detail is:

"This chargeback occurs when a customer claims they have paid for items that were to be delivered from your establishment but have not yet been received. This chargeback may be reversed by supplying proof that the customer has received the expected merchandise or evidence that credit was issued. This chargeback can be avoided by waiting to process the charge to the customers credit card until the merchandise has been shipped."

As you will note, it clearly states that you can have the chargeback reversed by supplying information showing that the merchandise was delivered or that a credit was issued.

A "Code 90" may not be your issue, but you can use this guide to likely find your exact chargeback reason.

NEXT: Find your proof and go the "extra mile"....

WRITING A LETTER ABOUT THE CHARGEBACK

I ALWAYS respond to a chargeback by writing "SEE ATTACHED" in the explanation area on the chargeback page then including all of my information AND a professionally typed letter.

In my letter I state all of the facts that contradict the bogus claims. For example, if the chargeback states the customer was "missing items", as I mentioned in my other article, I will pull the identical order and weigh it to prove no items were missing. I will also be sure to include that the customer has made no effort to contact us, despite our email, phone number and address being on their invoice and shipment notification / tracking number. I will go onto express that we do a wealth of transactions and recommend that the bank look into our outstanding history that lacks claims of this nature.

Never make your letter emotional; just stick to the facts and make it VERY CLEAR that the claims against your company are untrue. I have even went as far as calling the buyers local post office and speaking to a manager who states the parcel was delivered, then including his/her name, number and employee ID.

IF your website has policies about anything related to the issue, be sure to print them up to and include what page of your site the policy can be found on.

THE BANK MAY BE IN YOUR CORNER

According to TheConsumerist, The Top 10 Reasons a Chargeback is Denied consist of many things, but most importantly, quote "NOT GIVING THE MERCHANT A CHANCE TO FIX THE PROBLEM" and "DISPUTING THINGS FOR THE WRONG REASON"

So, as long as you have evidence of the chargeback being bogus, you stand a great chance of winning! Get into lawyer-mode!

* Take Our Survey then Keep Reading (Don't Worry, You'll Stay Right On This Page!)

TAKE OUR SURVEY TO HELP OTHERS

HOW MUCH WAS YOUR CHARGEBACK?

HOW TO FIGHT A CHARGEBACK... USE YOUR BRAIN

Now that you have the Chargeback Code, the evidence and you're in "Lawyer mode", it's time to combat the bogus claims. Think of whatever you can to go "above and beyond" to disprove the claims. Here's just a few ideas that may or may not apply to your issue:

1. Do you have receipts for the items to show they are authentic?

2. Proof you have tried to do everything reasonable for the customer and he/she is looking to get "freebies"

3. Send photographs of the item if need be (for example, if you only have one piece of it, and you took 8 photos, including closeups, send them!)

4. Weigh the items if need be

5. Prove the customer chose not to insure their purchase, although offered insurance

BASICALLY, whatever the chargeback code reason is, figure out how to prove the opposite.

CONTACTING THE CUSTOMER = LOST CAUSE

The dispute has already been filed, you WILL be charged for it regardless. Attempting to "work things out" after the dispute is pointless because everything is in the banks control. The customer filed their complaint and you must respond, to the bank. There's no point in trying to negotiate anything directly. Let the bank do their investigation; just give them the fuel they need to rule in your favor.

TAKE OUR POLL AND HELP OTHERS

Have You Won a Chargeback Dispute?

CHECK OUT MY OTHER ARTICLES

- How to Stop Credit Card Chargeback Fraud Scams

As a business, having a bogus / fraudulent credit card chargeback filed against you is awful, but I have found numerous ways to help prevent chargebacks from happening. - Received Domain Renewal Email to Fax 212-913-9858 SC...

Have you gotten a suspicious letter / email stating you must renew your domain name immediately via fax with your credit card information? Before you worry, read this article! - www.PersonnelConcepts.com Employee Law Poster SCAM

EMPLOYERS: The ALERT: Federal Labor Law Notice from Personnel Concepts Compliance Service Department letter is a SCAM. Please read this article before taking action! - What to Do if Your Google Gmail Has Been Hacked

Has your Gmail account been hacked? How to tell if you have indeed been hacked and how to solve the problem as quickly as possible - How to Stop Harassing Phone Calls from Google Voice ...

Google Voice is a service that allows users to make phone calls from a number other than their cell phone or landline. But what happens when the service is abused? Stop Harassment from Google Voice! - Getting Harassing Text Messages? How to Report Them ...

Harassing text messages come in many forms; from an angry / emotional individual to non-stop harassment from a business in the form of Text Spam. Learn how to solve your SMS Harassment - Why Gmail is Perfect for Staying in Touch with your ...

Once you read story this you will begin to understand how Gmail can make your life so much simpler. By just using it to contact customers and tips on how to get customers info the right way. - What to Do if Yahoo Email Has Been Hacked

How to tell if your email has been - Received Domain Renewal Email to Fax 212-913-9858 SC...

Have you gotten a suspicious letter / email stating you must renew your domain name immediately via fax with your credit card information? Before you worry, read this article! - How to Stop and Report Youtube Harassment Stalking

Cyberbulling isn't just related to teens. From co-workers to employees to relationships-gone-south; internet harassment comes in many forms, including YouTube. Learn how to Report and Stop it today!